Middle East

Israel and the Kurds: Forging Alliances in a Shifting Middle East

The relationship between Israel and the Kurdish people is increasingly significant amid the evolving geopolitical landscape of the Middle East. Historically marginalized, the Kurds have found in Israel a supporter of their aspirations, particularly in Syria, where the Kurdish struggle has gained international attention.

The Middle East’s shifting political dynamics, particularly since the events of October 7 that saw the defeat of the Shiite belt, have opened new avenues for Kurdish-Israeli relations. This shift has been further complicated by the lack of a direct border between the Kurdish regions and Israel, a fact that previously hindered more open interactions.

Dr. Ahmadi Mullah highlights that while the Palestinian issue has dominated Arab-Israeli relations since 1948, the Kurds were often left without such a spotlight, limiting their geopolitical leverage. However, the recent changes have presented new opportunities for Kurdish-Israeli cooperation, potentially altering the region’s power dynamics.

Dr. Sardar Aziz points to a new Middle East where power centers are increasingly fluid, featuring key players such as Israel, Turkey, and the Gulf countries. While the Gulf states exert growing influence due to the weakening of Iran, Iraq, and Syria, there is a concern about Turkey’s rising power potentially destabilizing the balance.

The Kurds, who have long sought recognition and rights within Iran, Iraq, Syria, and Turkey, often face accusations of attempting to establish an entity akin to Israel in the Middle East. Such comparisons are strategically used by their opponents to invoke regional and religious opposition against them.

The topic of Kurdish-Israeli relations remains a taboo, laden with emotional and political charges that complicate rational discourse. Turkey’s fluctuating relationship with Israel exemplifies the complex nature of regional alliances, which although strained at times, remains a model of strategic partnership that the Kurds might consider emulating.

Israel’s support for the Kurds, especially noted in Syria, is seen by some as a strategic move to secure an ally in a turbulent region. The alignment with Israel could potentially shield the Kurds from regional adversaries and foster stability through mutual support.

However, Dr. Mullah questions the long-term intentions behind Israel’s support, pondering whether it is a strategic ploy to exert pressure on Turkey or genuinely aimed at fostering regional peace. The Kurdish leadership must carefully navigate these international waters to leverage their geopolitical position without becoming overly reliant on fluctuating alliances.

The future of Kurdish-Israeli relations depends heavily on the Kurds’ ability to strategically engage with Israel and other regional powers. As the Middle East continues to experience profound transformations, the Kurds could potentially emerge as a significant player, but this will require nuanced diplomacy and a clear understanding of the regional and international stakes involved.

In conclusion, as Israel expresses open support for Kurdish aspirations, the potential for a meaningful alliance hangs in the balance, contingent on strategic decisions that will either cement the Kurds as a pivotal force in the Middle East or leave them as pawns in the broader geopolitical game.

Middle East

Norway Pulls Back Soldiers From Middle East Hotspots

As tensions rise across the Middle East, even smaller NATO members are adjusting their military footprint.

Norway is relocating some of its military personnel stationed in the Middle East, citing the deteriorating security situation in the region, the country’s armed forces confirmed Friday.

A spokesperson for Norway’s military said that some of the roughly 60 Norwegian soldiers currently deployed in the Middle East are being moved either back to Norway or repositioned within other countries in the region. The official did not specify the exact number of troops affected or the precise locations involved.

The decision comes amid escalating regional tensions, including increased military posturing by major powers and uncertainty surrounding ongoing diplomatic efforts related to Iran and broader Middle Eastern security.

Norwegian forces in the region are primarily engaged in training and advisory missions as part of international coalitions. Norway, a NATO member, has contributed personnel to multinational efforts focused on counterterrorism and regional stability.

Officials emphasized that the move is precautionary and based on ongoing assessments of risk to personnel. There was no indication that Norway plans a full withdrawal from its Middle East commitments.

The relocation reflects a broader pattern of allied forces adjusting deployments in response to heightened volatility across the region.

Middle East

UK Refuses Iran Strike Access, Trump Fires Back

Did Britain just say no to a potential U.S. strike on Iran? And is Diego Garcia now the center of a new transatlantic rift?

Britain has reportedly declined to approve U.S. use of its military bases for potential strikes on Iran, a decision that appears to have triggered sharp criticism from President Donald Trump over London’s planned handover of the Chagos Islands to Mauritius.

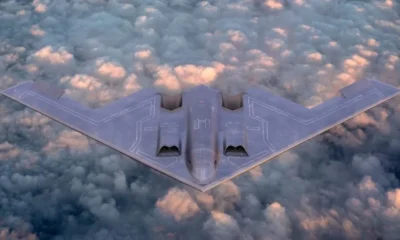

According to The Times, the White House is drafting military options that could involve Diego Garcia — a key joint U.S.-UK base in the Indian Ocean — as well as RAF Fairford in Gloucestershire, home to America’s heavy bombers in Europe.

Under longstanding bilateral agreements, U.S. forces require British approval before launching offensive operations from UK territory.

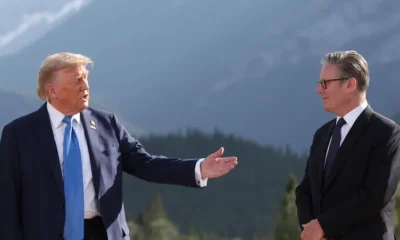

The report suggests that Prime Minister Keir Starmer has not granted that approval, as Washington weighs military action following stalled nuclear talks with Tehran and months of rising tensions.

Hours after speaking with Starmer, Trump publicly lashed out at Britain’s agreement to lease Diego Garcia to Mauritius for 100 years as part of a sovereignty settlement over the Chagos archipelago. Writing on Truth Social, Trump warned Starmer not to “give away” the strategic base, arguing it could prove vital if the U.S. conducts operations against Iran.

“We will always be ready, willing, and able to fight for the UK,” Trump wrote, urging Britain to remain “strong.”

Diego Garcia has long served as a cornerstone of U.S. power projection in the Middle East and Indo-Pacific. Its role becomes especially sensitive as Washington positions aircraft carriers and other assets within range of Iran, while pressing Tehran for major concessions on its nuclear program.

The British Foreign Office defended the Mauritius agreement, stating that it guarantees the long-term future of the base and remains “crucial to the security of the UK and our key allies.”

The apparent disagreement underscores deeper strains in transatlantic coordination over Iran. While the U.S. has threatened military action if diplomacy fails, Britain’s reported hesitation highlights the political and strategic complexities facing Western allies as tensions escalate.

With nuclear negotiations unresolved and military planning underway, Diego Garcia has unexpectedly emerged as a flashpoint in both Middle East strategy and Anglo-American relations.

Middle East

U.S. Plans Full Withdrawal of 1,000 Troops from Syria

After years on the ground in Syria, the U.S. may be pulling out entirely. What does this mean for ISIS, the Kurds — and Iran?

The United States is preparing to withdraw all of its roughly 1,000 troops from Syria over the next two months, according to multiple U.S. media reports, marking a significant shift in Washington’s military posture in the Middle East.

The Wall Street Journal first reported the planned pullout, citing unnamed officials who said the decision follows the Syrian government’s consolidation of control across much of the country. Television network CBS also reported the withdrawal plan, referencing U.S. officials familiar with the matter.

American forces have already vacated several key installations, including bases at al-Tanf and al-Shadadi, which had been central to the U.S.-led coalition’s campaign against ISIS. Those positions were long viewed as strategic footholds in eastern Syria, particularly near the Iraqi border.

The move comes amid broader political shifts inside Syria. After the fall of former President Bashar al-Assad in late 2024, Washington has cautiously engaged with Syria’s new authorities. At the same time, the Kurdish-led Syrian Democratic Forces — once a crucial U.S. partner in combating ISIS — have pledged to integrate into the Syrian state structure.

Thousands of ISIS detainees previously held in Syrian facilities have been transferred to more secure sites in Iraq, according to the reports, reducing one of Washington’s major security concerns tied to its presence.

The planned withdrawal unfolds against a backdrop of rising tensions elsewhere in the region. The United States has recently increased its military deployments near Iran, where officials have warned of retaliatory action if attacked. Separate reports indicate Washington is positioning assets that could be used for potential strikes against Iranian targets, though President Donald Trump has not publicly finalized any decision.

The Pentagon has not officially confirmed the Syria withdrawal plan and did not immediately respond to requests for comment.

If carried out, the exit would close a chapter in a military mission that began during the fight against ISIS and evolved into a complex balancing act involving Kurdish allies, regional rivals, and shifting alliances across a fractured Syrian landscape.

Middle East

Trump’s Board of Peace Faces Immediate Reality Test

Billions pledged. Troops promised. Hamas still armed. Can Trump’s new “Board of Peace” actually change Gaza — or is the hardest part just beginning?

U.S. President Donald Trump is set to preside over the inaugural meeting of his newly formed “Board of Peace” on Thursday in Washington, bringing together representatives from more than 45 countries to discuss Gaza’s post-war future. The gathering, however, begins under the shadow of unresolved and politically explosive questions.

At the renamed Donald J. Trump U.S. Institute of Peace, the president is expected to announce that participating nations have pledged more than $5 billion toward Gaza’s reconstruction. According to U.S. officials, the United Arab Emirates and Kuwait are each contributing roughly $1.2 billion, forming a substantial portion of the initial fund.

Yet the financial pledges are only a starting point. Rebuilding Gaza after two years of war is projected to require tens of billions of dollars, and key operational details remain unsettled. Among the most contentious issues: the disarmament of Hamas, the deployment timeline of an International Stabilization Force, and the mechanism for distributing humanitarian aid to civilians.

Senior U.S. officials say several countries are prepared to send thousands of troops to participate in the stabilization force. However, its deployment hinges on Hamas relinquishing weapons — a demand the militant group has resisted despite last October’s fragile ceasefire agreement.

The structure of the Board itself has stirred controversy. Israel is represented, but Palestinian officials are not. Permanent members of the United Nations Security Council — including France, Britain, Russia and China — are also absent. Critics argue the initiative risks sidelining established multilateral frameworks traditionally led by the United Nations.

Speakers are expected to include Secretary of State Marco Rubio, U.S. envoys Steve Witkoff and Jared Kushner, former British Prime Minister Tony Blair, and U.S. Ambassador to the UN Mike Waltz. Former UN diplomat Nickolay Mladenov is also slated to participate.

Behind closed doors, diplomats acknowledge formidable obstacles. Security in Gaza remains fragile. Local policing capacity is limited. Aid distribution channels are described by officials as “disastrous.” Even basic questions — such as who negotiates directly or indirectly with Hamas — remain unresolved.

For Trump, the meeting is both a diplomatic test and a political statement. The pledges offer momentum. But without clarity on enforcement, governance, and demilitarization, the Board of Peace faces a stark reality: money alone cannot stabilize Gaza.

Middle East

Russia Warns Against Any New U.S. Strike on Iran

Russia Warns Against Any New U.S. Strike on Iran After Geneva Talks

Russian Foreign Minister Sergei Lavrov warned on Wednesday that any fresh U.S. military strike on Iran would carry “serious consequences,” urging restraint and a diplomatic solution following the latest round of indirect U.S.–Iran negotiations in Geneva.

In an interview with Saudi broadcaster Al-Arabiya, broadcast a day after U.S. and Iranian envoys met in Switzerland, Lavrov said further strikes — especially on nuclear sites — risked dangerous escalation and could undo recent regional rapprochements, including improved ties between Tehran and Gulf states.

He said Arab Gulf monarchies had signaled that they did not want tensions to rise, calling the situation “playing with fire.”

Lavrov emphasized the need to preserve Iran’s right to a peaceful nuclear programme under international law and avoid actions that could destabilize the Middle East, underscoring Russia’s position that diplomacy should take precedence over force.

The warning comes amid a significant U.S. military buildup in the region, including the deployment of two aircraft carrier strike groups, as Washington pressures Tehran over its nuclear activities and broader regional conduct.

Iran is expected to submit a written proposal to address U.S. concerns after the Geneva talks, a senior U.S. official told Reuters, but negotiations remain far apart on core issues.

Middle East

Iran and Russia Launch Joint Naval Drills

Diplomacy in Switzerland. Warships in the Gulf. The message from Tehran is clear.

Iran and Russia are set to conduct joint naval exercises in the Sea of Oman on Thursday, Iranian state media reported, just days after a second round of Oman-mediated nuclear talks between Tehran and Washington in Geneva.

According to the semi-official ISNA news agency, Rear Admiral Hassan Maghsoudloo said the drills would take place in the Sea of Oman and the northern Indian Ocean, with the stated aim of strengthening maritime security and deepening naval cooperation between the two countries. The duration of the maneuvers was not disclosed.

The exercises follow heightened military activity in the region. Earlier this week, Iran’s Islamic Revolutionary Guard Corps launched separate drills in the Strait of Hormuz, a critical chokepoint for global oil and gas shipments. Tehran briefly restricted sections of the strait for “security” reasons during live-fire exercises, though it has never fully closed the waterway despite repeated threats during past standoffs with the United States.

The Strait of Hormuz, through which roughly a fifth of the world’s oil passes, has long been a flashpoint in US-Iran tensions. President Donald Trump has deployed what he described as an “armada” of American naval assets to the region amid renewed nuclear negotiations.

Russia’s Defense Ministry said its warships, alongside Iranian and Chinese vessels, conducted artillery drills and simulated counterterrorism operations in the Gulf of Oman earlier this week. Crews practiced daytime and nighttime firing at mock unmanned boats and aerial targets, as well as joint boarding operations to free a vessel seized by simulated militants. Russian agencies reported the ships later returned to the Iranian port of Chabahar.

The maneuvers come against a backdrop of cautious optimism in Tehran following the latest talks in Geneva. Previous negotiations collapsed after an Israeli strike on Iranian targets in June 2025 triggered a 12-day conflict that briefly drew in the United States.

While diplomats speak of possible progress, the parallel display of naval coordination between Moscow and Tehran underscores a familiar reality: even as talks resume, military signaling remains central to the standoff.

Middle East

Iran Temporarily Closes Strait of Hormuz as Nuclear Talks With US Continue

21% of the world’s oil passes through Hormuz. Iran just shut parts of it down. Message to Washington — or warning to the world?

Iran on Tuesday temporarily closed sections of the Strait of Hormuz for live-fire naval drills, marking the first such move since the 1980s and escalating tensions as nuclear negotiations with the United States continue in Geneva.

The Islamic Revolutionary Guard Corps announced that parts of the strategic waterway would be shut for several hours during exercises north-west of the USS Abraham Lincoln carrier strike group, while the USS Gerald R. Ford heads toward the region. Iranian state television aired footage of cruise missiles launched during the drills.

The Strait of Hormuz, a narrow corridor just 24 miles wide at its tightest point, handles roughly 21 percent of the world’s oil supply — about 21 million barrels per day. Any sustained closure would likely send global energy prices sharply higher and disrupt international markets. Iran has previously threatened to block the strait but has never fully closed it.

Supreme Leader Ali Khamenei intensified the rhetoric, warning that U.S. aircraft carriers could be sent “to the bottom of the sea,” dismissing American military superiority. The remarks appeared aimed as much at a domestic audience as at Washington, as Iran’s leadership faces internal divisions following a deadly protest crackdown earlier this year.

In Geneva, indirect talks mediated by Oman ended without a breakthrough. Foreign Minister Abbas Araghchi said the sides agreed on “guiding principles” and would exchange draft texts before a possible third round. A U.S. official said Tehran would return within two weeks with detailed proposals addressing remaining gaps.

Vice President JD Vance said the talks were mixed: “In some ways, it went well … but the president has set some red lines that the Iranians are not yet willing to acknowledge.” He reiterated that Washington would prevent Iran from obtaining a nuclear weapon “whether it’s through diplomatic options or through another option.”

President Donald Trump has maintained military pressure, deploying additional naval assets while insisting he prefers a negotiated settlement.

With naval drills underway, aircraft carriers in position and draft texts pending, the region now balances between diplomacy and deterrence — and the world’s energy markets are watching closely.

Middle East

Netanyahu Demands Iran Relinquish Enriched Uranium

Israel wants all uranium out of Iran. Tehran calls zero enrichment a red line. Can diplomacy survive?

Israeli Prime Minister Benjamin Netanyahu said Sunday that any nuclear agreement between the United States and Iran must require Tehran to surrender all enriched uranium and permanently forgo further enrichment.

Speaking in Jerusalem ahead of a new round of indirect U.S.-Iran talks in Geneva, Netanyahu insisted that “all enriched material has to leave Iran” and that there must be “no enrichment capability” left inside the country.

His remarks come as envoys prepare to meet Tuesday in Switzerland, where U.S. representatives including Steve Witkoff and Jared Kushner are expected to hold discussions with Iranian negotiators led by Foreign Minister Abbas Araghchi.

Iran, however, has made clear that a total halt to enrichment is unacceptable. Deputy Foreign Minister Majid Takht-Ravanchi told the BBC that zero enrichment violates Iran’s rights under the Nuclear Non-Proliferation Treaty and remains a red line. Still, he said Tehran is willing to discuss diluting its stockpile of uranium enriched to 60 percent if Washington is prepared to negotiate sanctions relief.

The dispute underscores a fundamental gap. Under the 2015 nuclear agreement — formally known as the Joint Comprehensive Plan of Action — Iran accepted strict limits on enrichment and international inspections in exchange for sanctions relief. President Donald Trump withdrew the United States from that deal during his first term.

Now, Washington has increased military pressure while emphasizing diplomacy. The United States has deployed two aircraft carriers to the Middle East, and Secretary of State Marco Rubio said additional naval forces are in place to counter potential threats. Rubio reiterated that Trump prefers a negotiated outcome over military confrontation.

Netanyahu, who recently met Trump at the White House, said he conveyed skepticism about the prospects for a durable agreement unless Iran’s ballistic missile program and regional proxy support — including for Hamas and Hezbollah — are also addressed.

With Israel demanding complete dismantlement, Iran rejecting zero enrichment, and Washington balancing pressure with diplomacy, the Geneva talks face steep obstacles — and little margin for miscalculation.

-

Minnesota2 months ago

Minnesota2 months agoFraud Allegations Close In on Somalia’s Top Diplomats

-

Middle East2 months ago

Middle East2 months agoTurkey’s Syria Radar Plan Triggers Israeli Red Lines

-

Editor's Pick2 months ago

Editor's Pick2 months agoWhy India Is Poised to Become the Next Major Power to Recognize Somaliland

-

ASSESSMENTS2 months ago

ASSESSMENTS2 months agoSomalia’s Risky Pact with Pakistan Sparks Regional Alarm

-

Analysis2 months ago

Analysis2 months agoTurkey’s Expanding Footprint in Somalia Draws Parliamentary Scrutiny

-

Analysis2 months ago

Analysis2 months agoRED SEA SHOCKER: TURKEY’S PROXY STATE RISES—AND ISRAEL IS WATCHING

-

Somaliland1 month ago

Somaliland1 month agoF-35s Over Hargeisa: The Night Somaliland’s Sovereignty Went Supersonic

-

Somalia2 months ago

Somalia2 months agoIs Somalia’s Oil the Price of Loyalty to Turkey? MP Blows Whistle on Explosive Oil Deal